Surcharges and What They Mean For Buyers & Sellers

One of the most common questions casting buyers have about their costs is what are the various reasons and ways surcharges are applied to the final casting price.

Surcharges come in different configurations. In the metalcasting industry, they fall in two general categories: energy and metal. Energy surcharges are not as common as metal surcharges. Energy surcharges are usually calculated as a percentage of the price of the casting but can also be configured based on the weight of the casting. Energy surcharges have been deployed in the past to offset regional transportation or energy supply surcharges imposed upon metalcasters by local municipalities or freight companies.

The purpose of metal surcharges is to offset the fluctuating costs of metal. The standard procedure is for a base price to be agreed upon, and then a surcharge applied. Somehow, metal surcharges have become one of the least understood aspects of metalcasting business practices. The answer to why may be in the differing business viewpoints. Without metal surcharges, metalcasters would lose money (because of increases in metal pricing) and go out of business. With surcharges, buyers no longer know what the price of a casting will be on delivery, as the invoiced amounts can fluctuate. Additional complications arise when you consider there could be different policies and calculations on the part of the seller at play.

There are two sides to every surcharge: the applier of the surcharge and the payer of the surcharge. Most of us are familiar with this idea as we see it on our own utility bills and gasoline pump costs on a regular basis. However, as consumers, many of us simply pay that surcharge and accept it as the cost of getting what we want. The same can be true for casting buyers, but when you consider today’s electronic information processing in business, the picture gets a little bit cloudier. Some buyers’ accounting systems have difficulty in reconciling the price they placed on their purchase order with the invoiced amount—including surcharges—coming from the metalcaster. This type of misunderstanding can result in a delayed payment of an invoice, multiple emails and/or phone calls to resolve the issue, and sometimes, a weakening in the trust between buyer and seller.

There are two sides to every surcharge: the applier of the surcharge and the payer of the surcharge. Most of us are familiar with this idea as we see it on our own utility bills and gasoline pump costs on a regular basis. However, as consumers, many of us simply pay that surcharge and accept it as the cost of getting what we want. The same can be true for casting buyers, but when you consider today’s electronic information processing in business, the picture gets a little bit cloudier. Some buyers’ accounting systems have difficulty in reconciling the price they placed on their purchase order with the invoiced amount—including surcharges—coming from the metalcaster. This type of misunderstanding can result in a delayed payment of an invoice, multiple emails and/or phone calls to resolve the issue, and sometimes, a weakening in the trust between buyer and seller.

To add fiscal structure to the example, this means the purchase order in the accounts payable environment for the buyer states the casting should cost $795, but the invoice coming from the metalcaster states the casting price as $835. The $835 includes the additional surcharge(s) as the metalcaster has applied it.

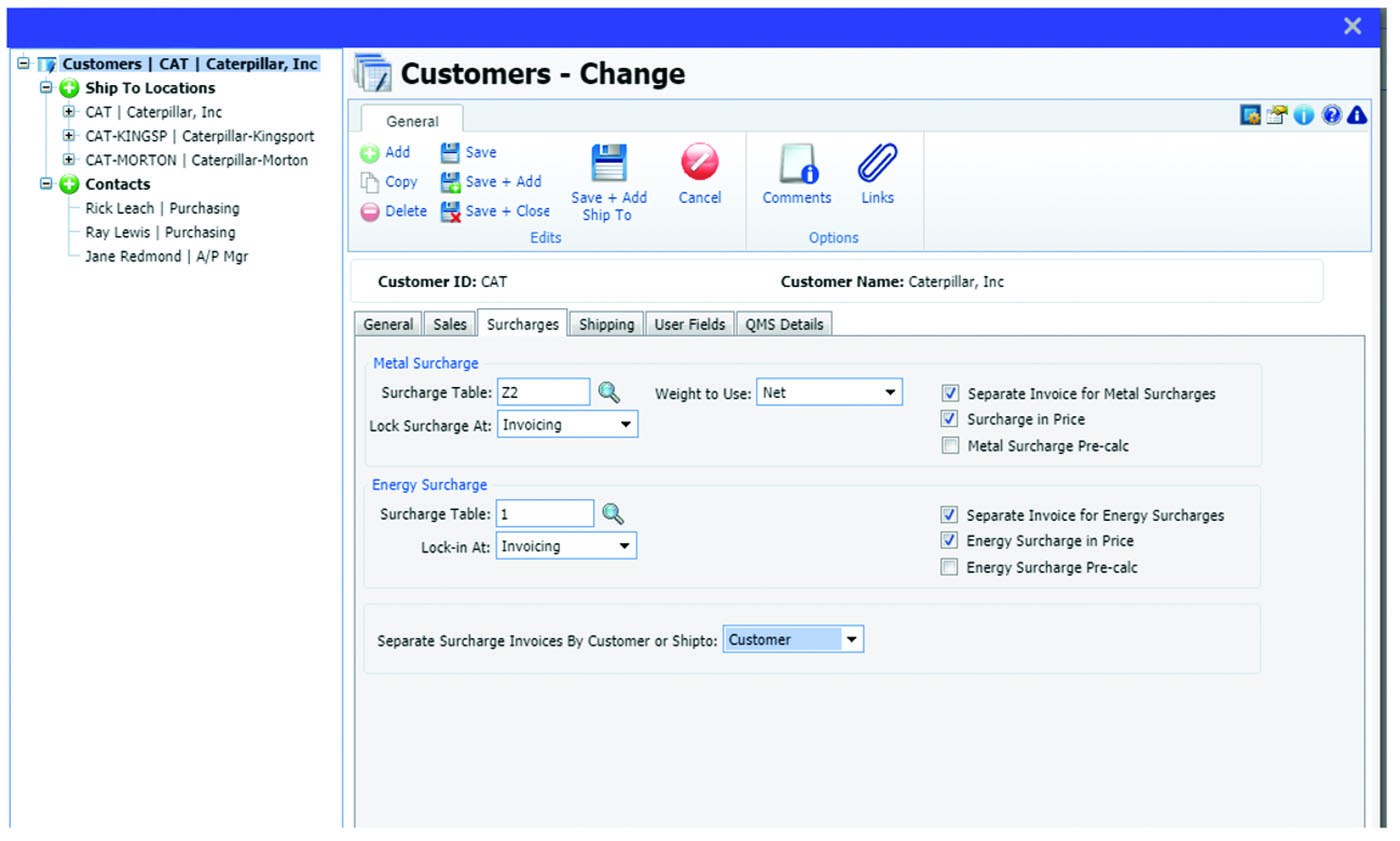

Through the use of modern enterprise resource planning (ERP) and invoicing practices, there are several options to help keep the purchase price and surcharge information clear for both buyer and seller. It can be as simple as typing in a line item explanation or checking a box in the software system (Fig. 1). From there, it’s a choice of invoicing type preference. Two commonly used invoice types are:

• Invoicing casting with surcharge via line item: The invoice sent to the casting buyer will have several line items on it, one line for the casting price of $795 and another line item for the additional surcharge amount of $40. This format may allow the invoice payment to occur more smoothly, but questions may still be raised if the buyers’ Accounts Payable staff is not aware of these additional charges.

• Invoicing surcharges separately: Some metalcasters will send the invoice for the casting at the price of $795, but “save up” all surcharges incurred over a set period of time (a quarter is common), and then send a separate invoice for those surcharges amounts.

There is no single way that all metalcasters handle surcharges. The processes are highly varied and can even vary among multiple metalcasters supplying the same or similar castings to the same buyer, but using different practices for the charging and collecting of those funds.

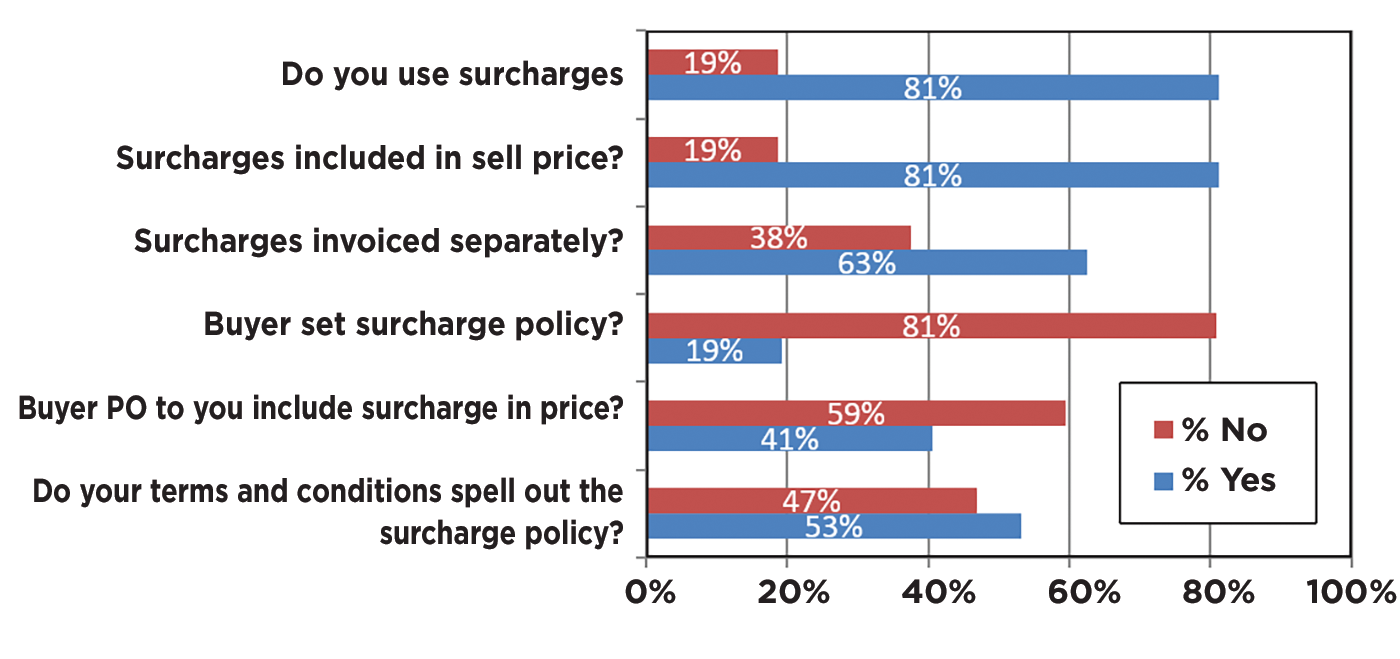

To explore the issue, a poll was conducted to determine what the varied surcharge processes are (Fig. 2).

While not strictly projectable, the trends are apparent:

1. Surcharges are used by the vast majority of metalcasters.

2. Those surcharges are either itemized or included in the selling price, depending on the buyer’s preference.

3. The inclusion of surcharges on invoices is a scattered process, with the definition of usage occurring either, a) during the presales effort or b) after receiving the purchase order from the casting buyer.

The poll results do not specifically indicate how the surcharges will be configured and who is setting the surcharge policy. As established, surcharges are calculated based on the weight of the casting and the type of metal used to create the casting. Online resources are available to both buyer and seller that indicate the fluctuating price of the various grades and types of metal available for use in the creation of these castings.

Seems simple enough, right? One would think so, but if the surcharge policy is not clearly defined upfront by the buyer or the seller, then subsequent accounting issues can, and usually do, arise. Currently, many ERP systems have some invoicing capabilities that allow for all of the varied processes of applying surcharges.

Yet, still, there is some amount of confusion on the part of the buyer side trying to pay for the castings they received. Perhaps it is that same old business demon—lack of communication.

Most respondents indicated they include their surcharge policy in the terms and conditions of their quote when it is sent to the casting buyer. Others send along their surcharge policy when they send an order acknowledgment form to the casting buyer accepting the buyer’s purchase order. Buyers will often send along their terms and conditions on their purchase order including their surcharge policy. Almost all of these definitions, provided by either the seller or the buyer, will indicate how the surcharge is to be calculated and billed. They can be very detailed—as specific as which metal market price tracker to be used.

Most respondents indicated they include their surcharge policy in the terms and conditions of their quote when it is sent to the casting buyer. Others send along their surcharge policy when they send an order acknowledgment form to the casting buyer accepting the buyer’s purchase order. Buyers will often send along their terms and conditions on their purchase order including their surcharge policy. Almost all of these definitions, provided by either the seller or the buyer, will indicate how the surcharge is to be calculated and billed. They can be very detailed—as specific as which metal market price tracker to be used.

The problem arises when the surcharge policy sent by the metalcasters is not in agreement with the surcharge policy sent by the casting buyer. This is where communication comes in. Care should always be taken up front to avoid any downstream negotiations. Foundries have to continue to make money, and often, the metal surcharge is the only way to assure this. Buyers may decide to go elsewhere to get that casting. What’s the answer here? It might be as simple as asking the right questions upfront.

Communication will always be the answer to managing the relationship between seller and buyer. It should never be just about the money; it’s about the future relationship and continued business prosperity. Understanding the same definitions and knowing what to ask can go a long way in making that relationship one based on mutual trust.

Click here to see this story as it appears in the September/October 2018 issue of MCDP.